No, IFSC codes and NUBAN numbers are different banking identification systems. You’ll find IFSC codes in India’s banking system as 11-character alphanumeric identifiers for banks and branches, while NUBAN operates in Nigeria as a 10-digit numerical system for account identification. While both enhance transaction accuracy, they serve distinct purposes in their respective countries. Understanding their unique structures and applications can help you navigate cross-border banking requirements more effectively.

Understanding IFSC Codes in Indian Banking

When conducting electronic fund transfers in India, understanding the IFSC code system is vital for guaranteeing successful transactions. This 11-character alphanumeric identifier serves as a significant component in digital banking operations, enabling precise routing of funds between bank branches across the country.

You’ll find that each IFSC code follows a specific structure: the first four characters identify the bank, followed by a mandatory zero in the fifth position, while the last six characters pinpoint the exact branch location.

The Reserve Bank of India oversees the issuance of these codes, which you can locate on your bank statements or through your bank’s official website.

For seamless fund transfers through NEFT, RTGS, or IMPS systems, you must provide the correct IFSC code to guarantee your money reaches its intended destination.

Key Components and Structure of IFSC Codes

The distinct components of an IFSC code create a precise identification system for banking operations throughout India.

You’ll find that every IFSC code follows a standardized 11-character structure, where each element serves a specific purpose in transaction routing.

The IFSC structure begins with four alphabetic characters that represent your bank’s identification code. This is followed by a mandatory ‘0’ in the fifth position, which acts as a delimiter. The remaining six characters uniquely identify the specific branch where you hold your account.

This systematic arrangement enables seamless electronic fund transfers through RTGS, NEFT, and IMPS platforms.

You’ll notice that while the first four characters remain constant for a particular bank, the final six characters vary across different branches, ensuring accurate routing of your transactions within India’s financial system.

NUBAN System in Nigerian Banking

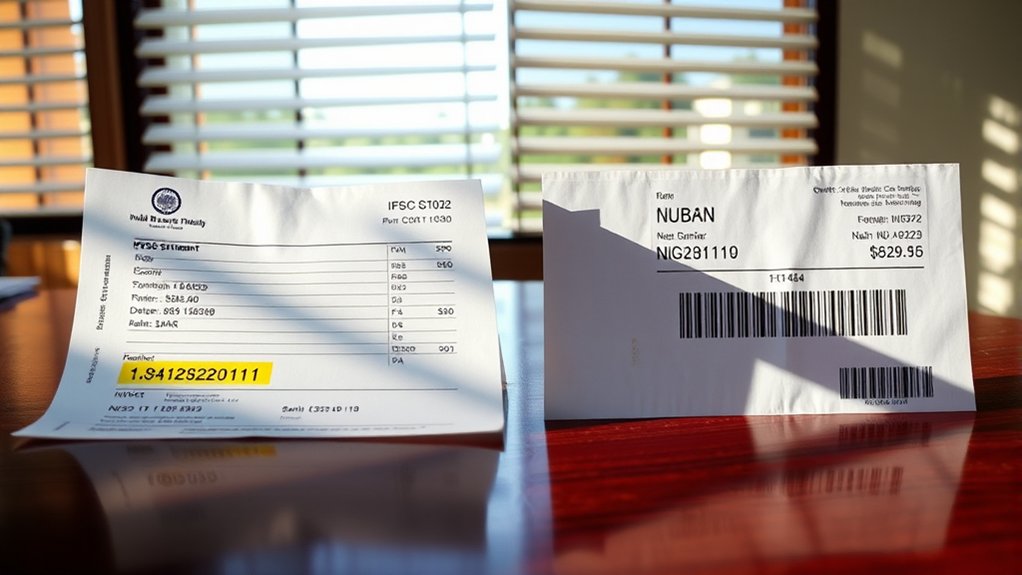

Nigerian banking operations rely on the NUBAN (Nigeria Uniform Bank Account Number) system, a standardized 10-digit identification protocol introduced by the Central Bank of Nigeria in 2011.

The NUBAN significance lies in its ability to uniquely identify bank accounts, ensuring precise payment processing and enhanced security for account holders across the country’s financial institutions.

In terms of NUBAN implementation, you’ll find these essential codes on your bank statements, correspondence, and through online banking platforms.

The system’s effectiveness in directing domestic transactions has led the Central Bank of Nigeria to propose expanding NUBAN numbers to 16 digits, aiming to further strengthen transaction accuracy and security measures.

This standardized system remains vital for conducting banking operations within Nigeria’s financial framework, serving as the cornerstone of domestic payment processing.

Main Differences Between IFSC and NUBAN

Understanding the distinction between IFSC codes and NUBAN numbers reveals two fundamentally different banking identification systems.

While both serve identification purposes, their structures and applications differ notably. IFSC advantages include its all-encompassing 11-character format that identifies both banks and specific branches, with built-in flexibility through its reserved fifth character for future modifications.

NUBAN limitations become apparent in its narrower focus on account identification, as it doesn’t incorporate branch-specific information within its 10-digit structure.

You’ll find IFSC codes exclusively operational within India’s financial framework, potentially shifting to IBAN, while NUBAN’s jurisdiction remains strictly within Nigeria’s banking system.

These geographical constraints highlight their specialized roles in their respective national financial infrastructures, making them distinct yet equally important for their intended markets.

Usage and Applications in Financial Transactions

When executing financial transactions across banking platforms, you’ll find distinct operational protocols for both IFSC and NUBAN systems. These identifiers serve as essential components for ensuring transaction accuracy and banking efficiency in their respective regions.

| Feature | IFSC | NUBAN |

|---|---|---|

| Length | 11 characters | 10 digits |

| Format | Alphanumeric | Numerical only |

| Primary Use | Interbank transfers | Account identification |

You’ll encounter IFSC codes primarily when initiating electronic fund transfers within India’s banking network, where the fifth character’s zero maintains system flexibility. Meanwhile, NUBAN numbers streamline Nigeria’s banking operations through their purely numerical format. Both systems enhance your ability to conduct precise financial transactions while minimizing errors in their respective banking ecosystems.

Global Banking Code Standards and Comparisons

Global banking systems employ distinct code standards that reflect each nation’s unique financial infrastructure and requirements. When you examine IFSC and NUBAN codes, you’ll find fundamental differences in their structure and purpose within their respective banking frameworks.

The IFSC’s 11-character format, with its designated fifth character zero for future adaptability, demonstrates India’s forward-thinking approach to code standards. In contrast, Nigeria’s NUBAN utilizes a streamlined 10-digit system focused purely on account identification.

While both systems serve their national banking needs, they’ve been tailored to meet specific market demands. These variations in global banking codes highlight how different countries develop standardized systems that best suit their financial ecosystems.

You’ll notice that despite their differences, both IFSC and NUBAN contribute to enhanced banking efficiency within their respective territories.